Learn More About Your Financial Journey

Download Today & Start Reading Instantly!

At Freedom Wealth Services, we create a customized plan to help you reach financial freedom based on your unique goals and priorities.

Below, we are offering complimentary downloads of some of our top financial insights to help you assess your current investment and retirement strategies. Start learning more about your path to retirement today!

Ages 5 to 55 Guide

What Your Kids Need to Know About Finances

You taught your kids how to tie their shoes, to look both ways before crossing the street, and countless other lessons. But what have you taught them about money? Many parents may feel uncomfortable talking about the subject with their children, no matter how old they are. But there are important financial lessons to teach your children at any age, and you should impart the wisdom you’ve accumulated. They may thank you for helping them make smart money moves early on and for having honest conversations about wealth transfer. Open and honest conversations are essential when estate planning. But before you get onto that topic, start with the small stuff. Let’s look at some important money lessons to teach your kids, starting with when they’re young.

Important Birthdays Over 50 Guide

NOW THE REAL FUN BEGINS

Happy Birthday! Now the real fun begins. Before you begin planning your retirement, be sure to mark these important dates in your calendar. Starting at age 50, several birthdays – including “half-birthdays” – are critical to understand because they have implications regarding your retirement income.

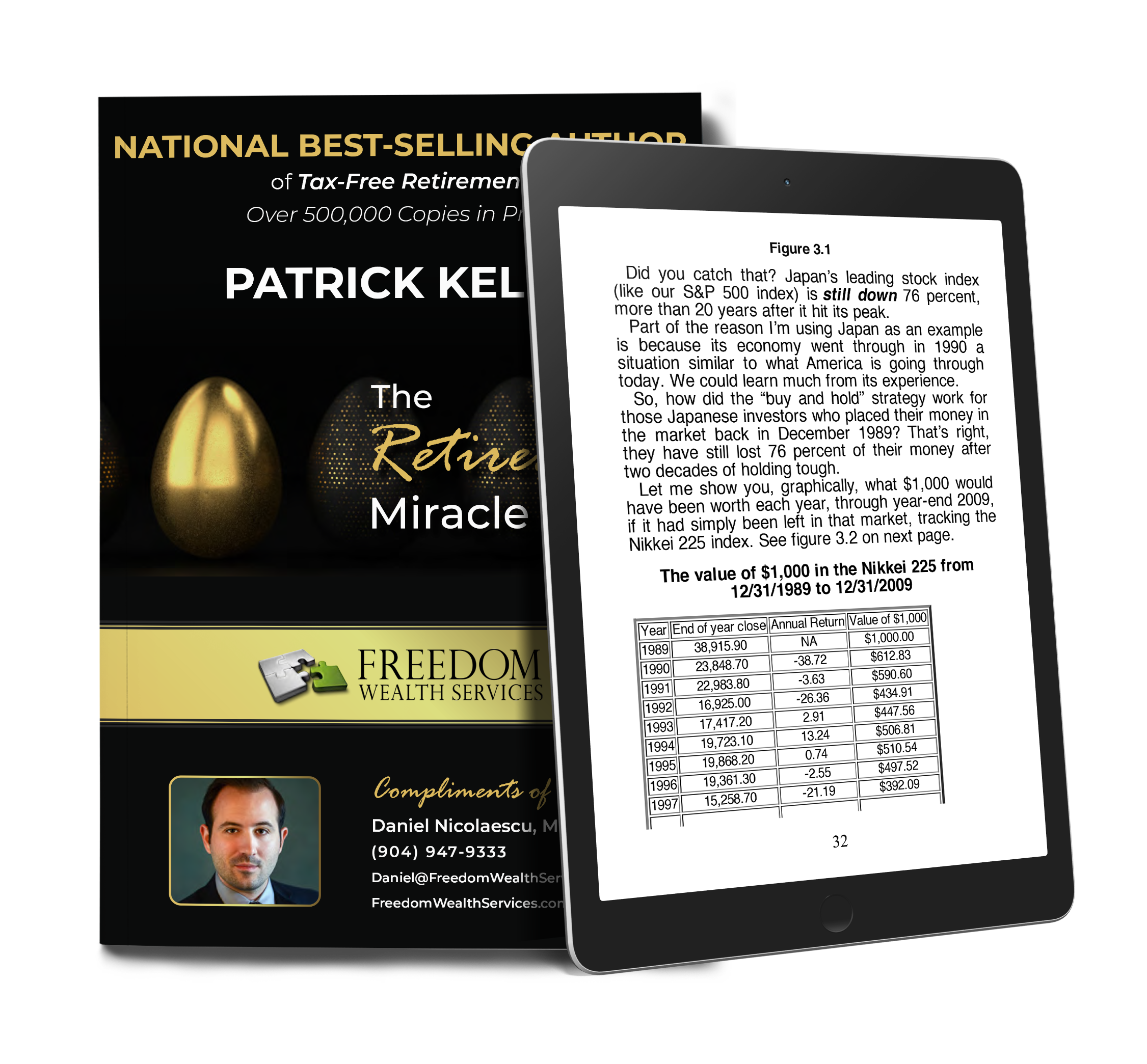

The Retirement Miracle

National Best-Selling Author of Tax-Free Retirement, Patrick Kelly.

An updated version to the National Best-Selling book “Tax-Free Retirement” with over 500,000 copies sold. This new edition includes all updated statistics showing how much in debt we really are and the solution to your own retirement. A must read for those who want to salvage his/her retirement. This book will show you how to grow your money with zero market risk, access your retirement dollars tax-free, and leave an income-tax-free inheritance to your heirs.

The Retirement Guide To a Life of Financial Freedom!

Retirement Resource Management For Today’s Savvy Investors

Given today’s new tax laws, people living longer in retirement, the cost of probate, inflation, the current volatility of the stock market and the availability of many new and innovative products, it makes it very difficult for most people to keep up to date and sort through it all. This booklet is intended to provide our friends, family, and clients with an overview of the information they need, to help them understand some of the many complex financial issues we all face in today’s economic environment. Today, many people are turning to a new breed of tax-deferred annuities, as a foundation of their overall financial plan, instead of mutual funds, certificates of deposit or municipal bonds.

Living Debt Free And Truly Wealthy

The Secret to Having a Tax-FREE Retirement!

Given today’s new tax laws, the current volatility of the stock market, new investment strategies and the availability of many new, innovative investment products, it makes it very difficult for most families to keep up to date and sort through it all. This booklet is intended to provide our friends, families and clients with an overview of the information they need, to help them understand some of the many complex financial issues we all face in today’s tough economic environment.

The 401(k) Alternative

IRS Approved – Tax Free

Max-funded Indexed Universal Life Insurance is a permanent life insurance policy that accumulates cash value through interest credited, based on an external index strategy, like the S&P. It aims to optimize cash vale growth by reducing life insurance costs, while offering vital protection for financial security.

Your Guide To Roth IRAs

Conversions and Advanced Tax Planning

An IRA is an investment account that you own that typically holds stocks, bonds, mutual funds, ETFs, and more. It is structured and regulated with limitations and tax advantages for using the account to grow a fund that is then used to provide you income in retirement. The Roth IRA is a tax-advantaged retirement account, but some of its tax advantages are structured differently than the Traditional IRA.

Tax Free Benefits for Long Term Care in a Post Covid World

By Don Quante

A Consumer’s Real-Life, Hands-On Guide To:

- Creating Tax-Free Money for Long-Term Care using the Pension protection Act.

- Using Your IRA for Long-Term Care.

- Veterans benefits for Long-Term Care including the Consumer Directed Care program.

- Medicaid Eligibility including the Consumer Directed Care program.

- How to Legally Protect Your Assets.